Paycheck commission calculator

The state tax year is also 12 months but it differs from state to state. Get an accurate picture of the employees gross pay including.

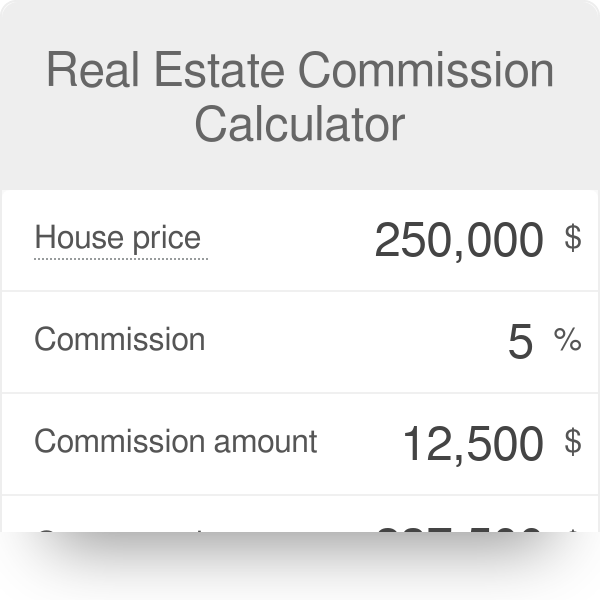

Real Estate Commission Calculator

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

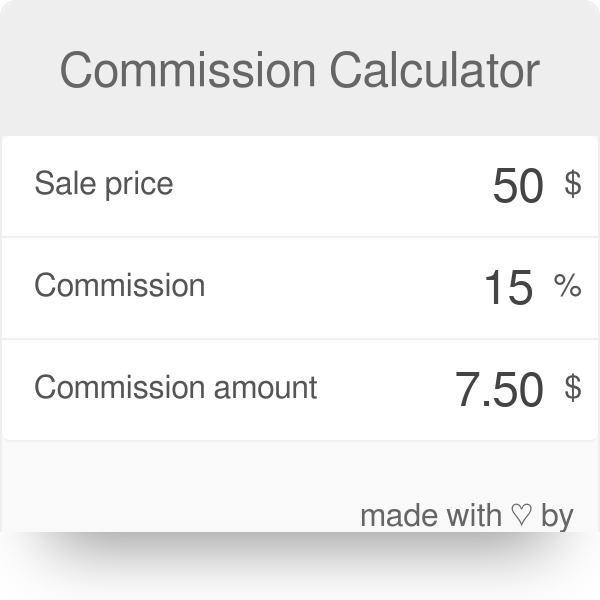

. You can calculator your commission by multiplying the sale amount by the commission percentage. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Some states follow the federal tax. Hourly Pay 15 x 50 hours 750. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Next divide this number from the. Federal Bonus Tax Percent Calculator.

In other words if you make a sale for 200 and your commission is. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. For example if an employee earns 1500.

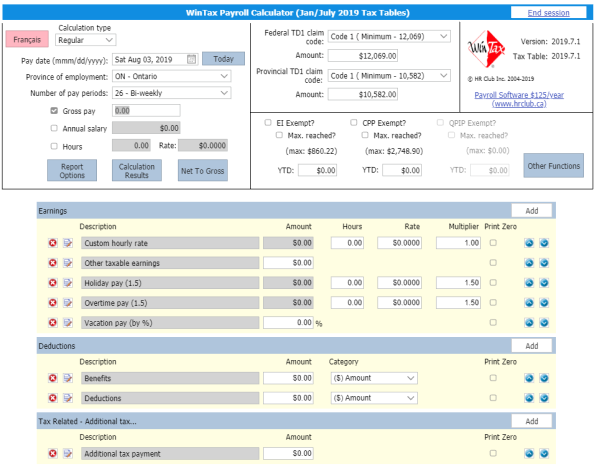

Get an accurate picture of the employees gross pay including. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. If you need to purchase ME click HERE.

Calculate your paycheck at any time using the methods below. Computes federal and state tax withholding for. How do I calculate hourly rate.

How to calculate annual income. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Your employer withholds a 62 Social Security tax and a. The following calculation show how a payroll system may breakdown the pay of an employee who is owed commissions and overtime pay. If your state does.

Get an accurate picture of the employees gross pay. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. This is a very basic calculation revolving around percentsJust take sale price multiply it by the commission percentage divide it by 100.

Wintax Calculator Wintax Canadian Payroll Software

Taxable Income Calculator India Income Business Finance Investing

How Do Realtors Get Paid Mortgage Marketing Mortgage Tips Realtors

Payroll Calculator Free Employee Payroll Template For Excel

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Payroll Calculator Free Employee Payroll Template For Excel

Ontario Income Tax Calculator Wowa Ca

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Take Home Pay With Paystub Maker Stubsondemand Calculator Paying Finance

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

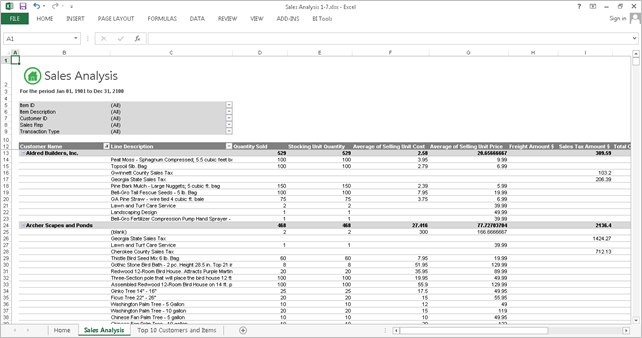

Learn How To Create A Sales Commission Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Avanti Gross Salary Calculator

Paycheck Calculator Take Home Pay Calculator

8 Best Images Of Weekly Budget Worksheet Free Printable Bi Weekly Personal B Budget Template Printable Printable Budget Worksheet Budget Spreadsheet Template

Paycheck Calculator Take Home Pay Calculator

Commission Calculator